Oklahoma Unemployment Exceeds National Rate First Time In 26 Years

<p>Gross Receipts to the Treasury continued their downward trajectory for an 18th consecutive month in August as unemployment figures released late in the month show Oklahoma’s jobless numbers exceed the national rate for the first time in 26 years, according to State Treasurer Ken Miller. </p>Tuesday, September 6th 2016, 12:50 pm

Gross Receipts to the Treasury continued their downward trajectory for an 18th consecutive month in August as unemployment figures released late in the month show Oklahoma’s jobless numbers exceed the national rate for the first time in 26 years, according to State Treasurer Ken Miller.

Reports released on Tuesday by Miller show gross receipts, which provide a broad view of state economic activity, were down by 4 percent in August compared to the same month of last year. Total collections during the past 12 months were off by more than 7 percent compared to the prior period, according to the reports.

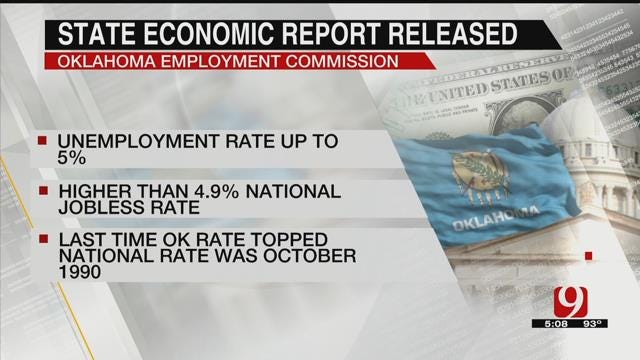

The revenue news comes as the Oklahoma Employment Security Commission reports the state’s unemployment rate at 5 percent, one-tenth of one percentage point higher than the national rate of 4.9 percent in July. The last time Oklahoma’s jobless rate topped that of the nation was in October 1990, OESC, when the national unemployment rate stood at 5.9% and Oklahoma's was 6.0%.

Miller, an economist, said he’s on the lookout for indications the contraction is ending.

“We keep scouring through the data to find signs of an impending turnaround, but it’s just not there,” said Miller. “Some aspects of the August report aren’t as negative as in prior months – a few revenue streams have ticked up slightly – but we can’t yet point to a positive trend.”

Unlike the past few months, August gross receipts show two revenue sources with slight improvements. Monthly collections from individual income and motor vehicle taxes were each around 5 percent higher than in August 2015. However, measured over the past 12 months, every major revenue stream remains lower than the prior one-year period, according to the Treasurer's office.

Collections from gross production taxes on oil and natural gas increased from the prior month for the fourth consecutive time, reflecting a slight rebound in wellhead prices. However, compared to the prior year, receipts remain suppressed.

August collections

The report for August lists gross receipts at $832.2 million, down $34.3 million, or 4 percent, from August 2015.

Gross income tax collections, a combination of individual and corporate income taxes, generated $254.2 million, a reduction of $4 million, or 1.53 percent, from the previous August.

Individual income tax collections for the month are $242.7 million, up by $12.3 million, or 5.3 percent, from the prior year. Corporate collections are $11.5 million, down by $16.3 million, or 58.5 percent.

Sales tax collections, including remittances on behalf of cities and counties, total $351.2 million in August. That is $21.5 million, or 5.8 percent, below August of last year.

Gross production taxes on oil and natural gas generated $31.8 million during the month, a decrease of $9 million, or 5.8 percent, from last August. Compared to July reports, gross production collections are up by $1.3 million, or 4.2 percent.

Motor vehicle taxes produced $68.7 million, up by $3 million, or 4.5 percent, from the prior year.

Other collections, consisting of about 60 different sources including taxes on fuel, tobacco, horse race gambling and alcoholic beverages, produced $126.3 million during the month. That is $2.7million, or 2.1 percent, less than last August.

Twelve-month collections

During the past 12 months, September 2015 through August 2016, gross revenue totals $1 million less than $11 billion. That is $903.8 million, or 7.6 percent, below collections for the previous 12-month period.

Gross income taxes generated $4.1 billion for the period, reflecting a drop of $317.9 million, or 7.2 percent, from the preceding 12 months, September 2014 to August 2015.

Individual income tax collections total $3.6 billion, down by $212.3 million, or 5.6 percent, from the prior 12 months. Corporate collections are $507.8 million for the period, a decrease of $105.6 million, or 17.2 percent, from the previous period.

Sales taxes for the 12 months generated $4.2 billion, a decrease of $217.4 million, or 4.9 percent, from the preceding period.

Oil and gas gross production tax collections brought in $347 million during the 12 months, down by $280.2 million, or 44.7 percent, from the trailing period.

Motor vehicle collections total $753.1 million for the period. This is a decrease of $15.3 million, or 2 percent, from the trailing 12 months.

Other sources generated $1.6 billion, down $73 million, or 4.4 percent, from the previous 12 months.

More Like This

September 6th, 2016

September 29th, 2024

September 17th, 2024

Top Headlines

December 23rd, 2024

December 23rd, 2024

December 23rd, 2024

December 23rd, 2024