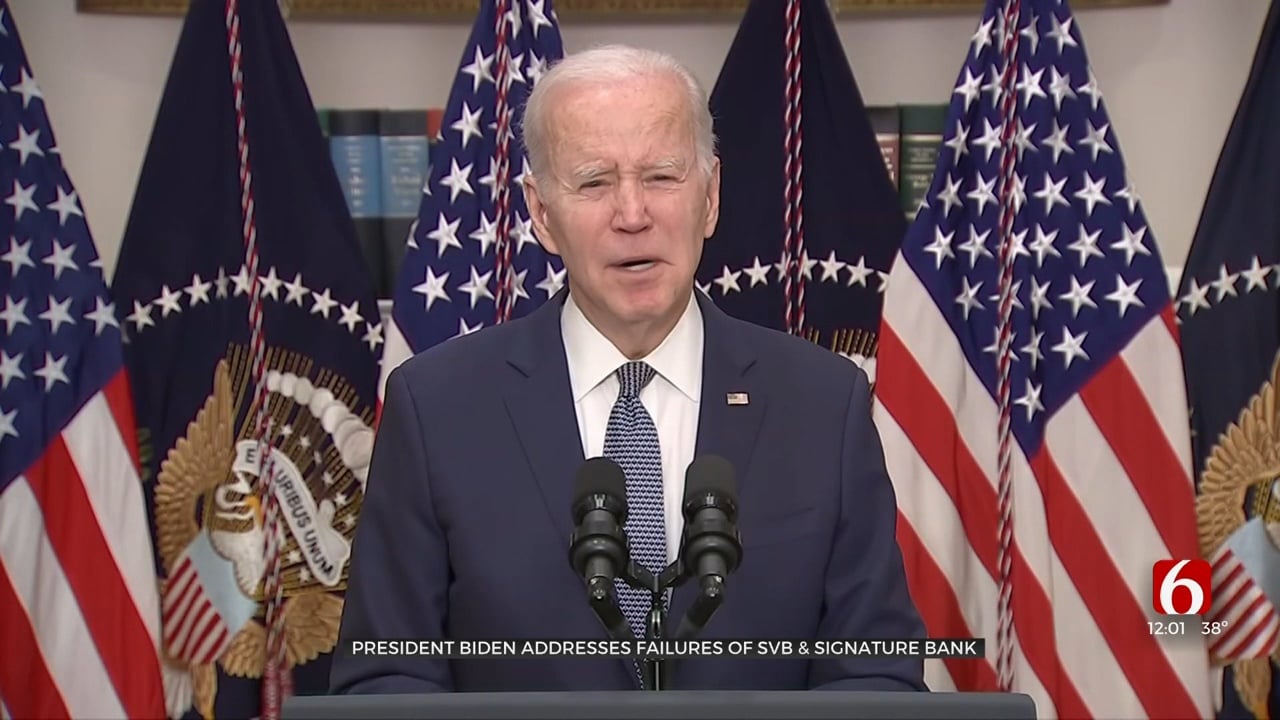

Biden Says Americans Can 'Rest Assured' Banking System Is Secure After Silicon Valley Bank Collapse

President Biden on Monday sought to reassure Americans that they can have confidence in the U.S. banking system following the collapse of Silicon Valley Bank and quell any concerns about the fallout from its abrupt failure.Monday, March 13th 2023, 12:49 pm

WASHINGTON -

President Biden on Monday sought to reassure Americans that they can have confidence in the U.S. banking system following the collapse of Silicon Valley Bank and quell any concerns about the fallout from its abrupt failure.

"Americans can have confidence that the banking system is safe," Mr. Biden said in brief remarks from the White House. "Your deposits will be there when you need them. Small businesses across the country that deposit accounts at these banks can breathe easier knowing they'll be able to pay their workers and pay their bills, and their hard-working employees can breathe easier as well."

The president's comments came after U.S bank regulators spent the weekend working on a plan to shore up the public's confidence in the soundness of the financial system and limit spillover effects following the closing of Silicon Valley Bank last week.

Biden administration officials announced Sunday that depositors with accounts at Silicon Valley Bank will have access to all of their money beginning Monday, and "no losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer."

The emergency action "fully protects" all depositors, Treasury Secretary Janet Yellen, Federal Reserve Board Chair Jerome Powell and Federal Deposit Insurance Corporation (FDIC) Chairman Martin Gruenberg said.

Mr. Biden reiterated during his remarks that "no losses will be borne by the taxpayers," and said the money will instead come from fees that banks pay into the Deposit Insurance Fund.

"Every American should feel confident that their deposits will be there if and when they need them," he said.

Investors in the banks, however, will not be protected, the president said, and management will be fired.

"They knowingly took a risk, and when the risk didn't pay off, investors lose their money. That's how capitalism works," Mr. Biden said.

The president also called for a "full accounting" of what led to the collapse of Silicon Valley Bank and a second institution, Signature Bank of New York, which was taken over by state regulators Sunday, and how to hold those responsible accountable.

"No one is above the law," Mr. Biden said.

The president said he intends to ask Congress and banking regulators to strengthen the rules for banks to stave off future failures.

"Americans can rest assured that our banking system in safe. Your deposits are safe," he said. "Let me also assure you we will not stop at this. We will do whatever is needed."

Mr. Biden spoke at the White House before traveling to San Diego, California, for meetings with Australian Prime Minister Anthony Albanese and British Prime Minister Rishi Sunak.

California regulators shut down Silicon Valley Bank on Friday after depositors rushed to withdraw money last week due to concerns about its balance sheet, and the FDIC was appointed receiver.

Silicon Valley Bank, which was 40 years old and ranked as the 16th largest bank in the U.S., catered largely to the tech industry and was used by many start-ups and venture capital firms. It is the largest financial institution to collapse since Washington Mutual at the height of the financial crisis in 2008.

In addition to federal government shoring up deposits at Silicon Valley Bank and Signature Bank, the Fed announced it is standing up a new emergency lending program, called the Bank Term Funding Program, "to help assure banks have the ability to meet the needs of all their depositors."

The FDIC is running day-to-day operations of Signature Bank, New York Gov. Kathy Hochul said Monday, and all deposits, including those above the agency's $250,000 insurance cap, will be protected.

"Our view was to make sure that the entire banking community here in New York was stable, that we can project calm, that this is a time that we could manage a certain narrow situation and to make sure that that did not get any worse," she said.

Hochul said the closure of Signature Bank "didn't happen in a vacuum," but rather was the effect of depositors watching what occurred at Silicon Valley Bank.

Yellen ruled out a federal bailout for Silicon Valley Bank's investors, telling "Face the Nation" in an interview that "we're not going to do that again."

The president said in a statement Sunday that the steps agreed to by his administration and banking regulators protects American workers and small businesses, and keeps our financial system safe."

"The solution also ensures that taxpayer dollars are not put at risk," he said. "The American people and American businesses can have confidence that their bank deposits will be there when they need them."

More Like This

March 13th, 2023

April 20th, 2024

Top Headlines

November 23rd, 2024

November 23rd, 2024

November 23rd, 2024

November 23rd, 2024