Oklahomans Take Issue With New Tax Refund Debit Card

The Oklahoma Tax Commission is handing out debit cards, instead of checks, for people who don't want their tax refunds direct deposited.Wednesday, March 7th 2012, 5:47 pm

Grant Sloan, News On 6

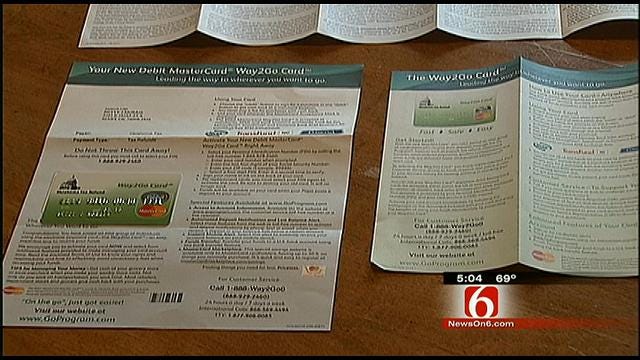

TULSA, Oklahoma -- For the first time, the Oklahoma Tax Commission is handing out debit cards, instead of checks for people who don't want their tax refunds direct deposited.

But for some taxpayers, the transition to paperless has caused more problems than it has solved.

Betty Morris considers herself pretty computer savvy.

She's worked with them her entire life. She manages the bank account online and even has a Facebook page.

But when she and her husband, Kenneth, filed a joint tax return this year, they ran into some problems.

"We did not want to use [the refund] as a debit card, or a credit card.... we wanted to transfer it to our account," Morris said.

But what was supposed to be a simple transfer, turned into quite the headache when she got online.

"My first thought was that I hit a wrong button, so I tried it again," she said.

"So then, my husband called the number, and that's where our problems begin," Morris said.

For the first time, Oklahoma has chosen to use debit cards for tax returns, instead of the old paper checks.

But if you're not careful, Betty said, you can quickly eat up your return in fees.

"I feel like if I'm not watching my pennies, there won't be any dollars to take care of," she said.

Under the card's guidelines, you can be charged a fee for money transfers, inactivity on the account, even if you just call and ask for help.

Bruce Smith works for the Oklahoma Tax Commission in Tulsa, and he said it is common to have issues with a new system.

"It's a new program, so there might be a few issues that pop up now and again," Smith said. "But for the most part it's been quite successful."

Smith said out of the 150,000 cards handed out this year, he's received very few complaints.

"Were doing what we can to work with everyone," Smith said.

And the part about the new debit cards being a step in the right direction? That's something with which Betty Morris agrees.

"This is great; it's just the way they did it," Morris said. "They just dumped it on us without... explanation."

More Like This

March 7th, 2012

September 29th, 2024

September 17th, 2024

Top Headlines

December 26th, 2024

December 26th, 2024

December 26th, 2024

December 26th, 2024