How to Spend Your Coronavirus Stimulus Check

The global coronavirus pandemic has had a devastating impact on the American economy. With many Americans laid off and struggling to pay for essentials, the federal government recently approved a $2 trillion stimulus...Tuesday, April 7th 2020, 6:13 am

By Rachel Cautero

The global coronavirus pandemic has had a devastating impact on the American economy. With many Americans laid off and struggling to pay for essentials, the federal government recently approved a $2 trillion stimulus package.

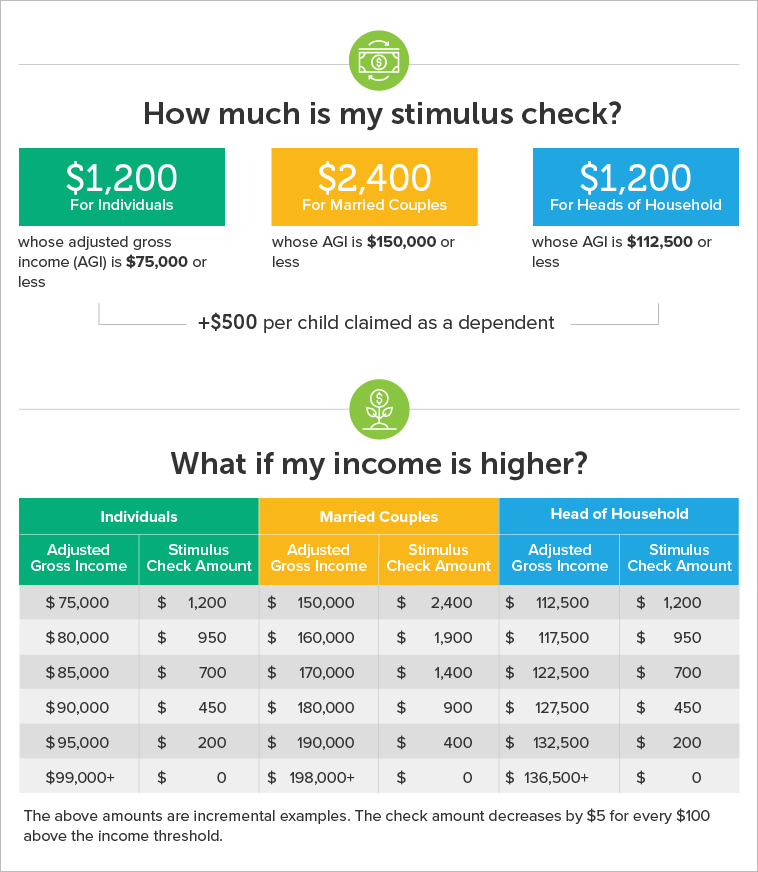

As part of this package, many Americans will receive stimulus checks – $1,200 for each adult and $500 per child, provided your gross adjusted income is less than $75,000 (as an individual) or $150,000 (as a married couple). Here’s how you should spend your stimulus check.

The BasicsIf you’re having trouble paying rent, monthly bills such as utilities and phone bills, or even covering your groceries, then your stimulus check should first be allocated there.

It’s estimated that as many as 47 million Americans could lose their jobs as a result of COVID-19, and many are already feeling the economic effects. If you find yourself jobless or struggling financially as a result of COVID-19, earmark your stimulus funds to cover your cost of living for the next few months until you can get back on your feet.

Grow Your Emergency Fund Less than half of Americans have enough in their emergency fund to cover a $1,000 emergency, a 2019 study found. If you find yourself in this group, you may want to tuck those stimulus funds away for a rainy day – a day which, given the trajectory of the economy, could be in the near future.

Less than half of Americans have enough in their emergency fund to cover a $1,000 emergency, a 2019 study found. If you find yourself in this group, you may want to tuck those stimulus funds away for a rainy day – a day which, given the trajectory of the economy, could be in the near future.

Since the virus gained a foothold in the US in late February, the stock market and the economy at large have taken a hit. Some industries, like travel, have been virtually shut down, while others (like restaurants and retail businesses) are being badly hurt by closures and stay-at-home orders. Predictably, unemployment has also risen, with 6.6 million workers filing for first-time unemployment benefits in the week ending March 28 – setting a record high for the second consecutive week.

Even if your financial situation is stable right now, padding your emergency fund is never a bad idea. It can act as a safety net if something changes – your industry takes a downturn, you lose your job, or you contract COVID-19 yourself.

Pay Off DebtIf you’re able to cover your bills and you have a health balance in your emergency fund, then paying off debt – especially the high-interest kind, like credit card debt – should be next on your list.

Many experts are predicting the COVID-19 pandemic will spark a recession, and if that happens, you’ll want to be prepared financially. Paying off debt can put you on more solid financial footing, allowing you to dedicate more to covering your living expenses and saving for retirement.

It’s generally a good idea to focus on your highest interest debt so as to minimize how much you’re paying in interest. Note, too, that if you’ve got a mortgage, now would be a good time to consider refinancing to take advantage of lower mortgage rates.

Refocus Your Investment StrategyIf you’re well-positioned to cover all your bills, you’ve padded your emergency fund and you’ve paid off any significant non-mortgage debt, then you may consider focusing your stimulus funds on your investments. While the crisis has pushed the stock market into bear market territory, markets are cyclical and eventually recover. Indeed, as of this writing, the market is already significantly off the lows it reached in the early days of the crisis – though there remains significant uncertainty.

As such, you might pursue an investing strategy that balances growth with capital preservation. One strong option is to invest in shares that are relatively unaffected by a recession, such as utilities, consumer staples and healthcare. Such shares tend to do well in a bear market, though they often lag in a bull market.

Dividend investing is another option worth a close look. Companies that pay strong dividends often do so as a compensation to shareholders for low growth in share values. If you would rather not spend time hunting for shares with the high dividend yield, consider a dividend exchange-traded fund.

If you feel that the worst of the market volatility is over, shift your focus to capital appreciation. You have a number of possibilities, including small- and micro-cap shares, aggressive growth stocks, options trading, and foreign and emerging market shares.

As always, though, remember that it’s hard to effectively time the market. While it’s easy in retrospect to see when a bear market has shifted back into bull market territory, in real time it’s difficult to be sure. If you’re investing for the long term, consider sticking with your existing strategy rather than try to time the market’s ups and downs.

Support Small Businesses You’ve probably heard this one before: Now is the time to support local small businesses, from online shops and cleaning services to your local restaurants. If you’re fortunate enough to have stable employment and a healthy emergency fund, you might consider spending your windfall to support businesses in your community.

You’ve probably heard this one before: Now is the time to support local small businesses, from online shops and cleaning services to your local restaurants. If you’re fortunate enough to have stable employment and a healthy emergency fund, you might consider spending your windfall to support businesses in your community.

It’s not just a matter of being charitable. The shuttering of these businesses can have ripple effects on the economy, and extensive closings in your immediate area could have lasting effects on your property values. So keeping them in business is in everyone’s best interests.

The Bottom LineAs part of the federal government’s $2 trillion stimulus package, many Americans will receive stimulus checks to help offset the economic impact of the outbreak. The amount of these checks are $1,200 for each adult and $500 per child, provided your gross adjusted income is less than $75,000 as an individual or $150,000 as a married couple. For people above those income limits, the stimulus check amount gradually phases out.

You should spend your stimulus check on basics like rent, food, and healthcare if you find yourself struggling financially. Padding your emergency fund is a solid next step, as is paying off debt. Once you’ve done that, consider investing for the future. And if you’re lucky enough to be financially secure and feel comfortable with your savings and investments, consider supporting small businesses.

Managing Your Personal Finances- A financial advisor can help you build a financial plan that can see you through economic uncertainty. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- If you decide to invest your coronavirus stimulus check, consider talking to a chartered financial analyst. This person can provide you with advice on how to invest your money, whether in a market downturn stemming from a pandemic, or a bull market.

Photo credit: ©iStock.com/adamkaz, ©iStock.com/designer491, ©iStock.com/South_agency

The post How to Spend Your Coronavirus Stimulus Check appeared first on SmartAsset Blog.

Information contained on this page is provided by an independent third-party content provider. Frankly and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact pressreleases@franklymedia.com

More Like This

April 7th, 2020

December 28th, 2024

December 28th, 2024

December 28th, 2024

Top Headlines

December 28th, 2024

December 28th, 2024

December 28th, 2024