Your Money Matters: New Consumer Protections For 'Buy Now, Pay Later' Loans

The Consumer Financial Protection Bureau said lenders that offer interest-free payments in limited installments like Afterpay, Affirm, Klarna, and Paypal, must follow the same federal rules as credit card companies.Thursday, May 23rd 2024, 12:54 pm

TULSA, Okla. -

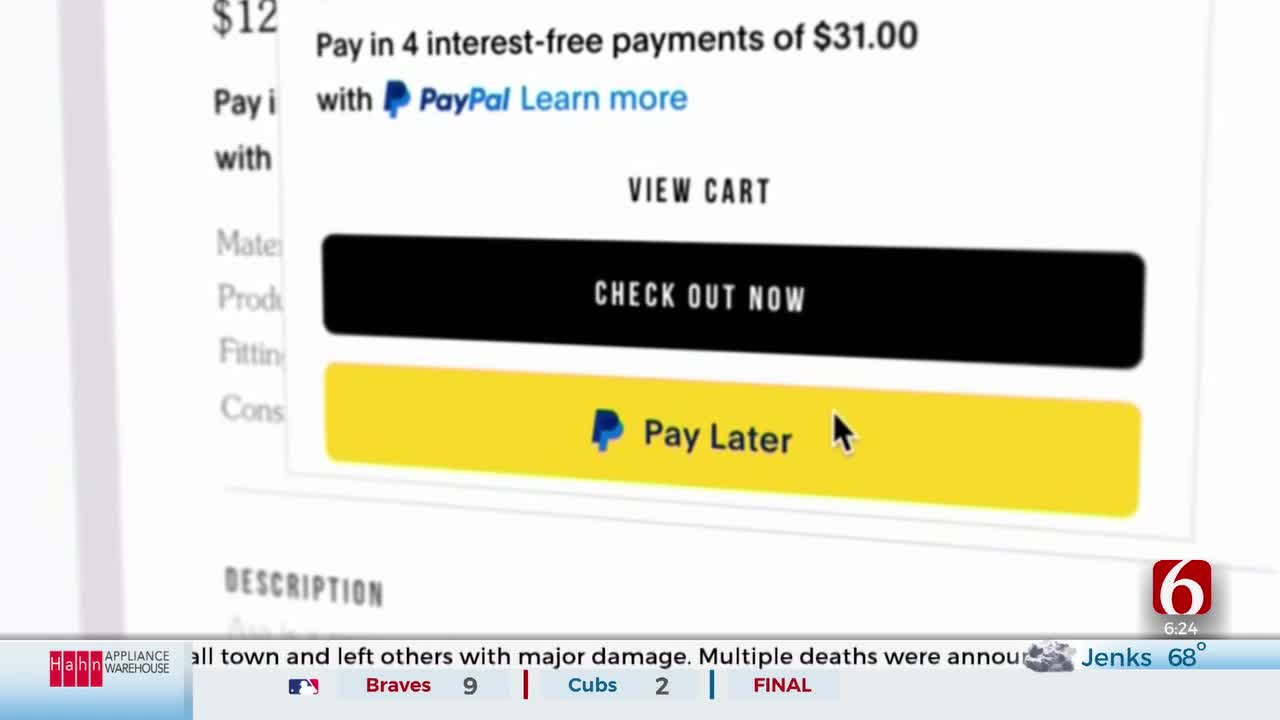

If you use Buy Now, Pay Later plans, listen up. The Biden Administration announced those consumers are entitled to the same protections as credit card users.

The Consumer Financial Protection Bureau said lenders that offer interest-free payments in limited installments like Afterpay, Affirm, Klarna, and Paypal, must follow the same federal rules as credit card companies.

This means lenders must investigate customers' disputes on charges, allow shoppers to demand refunds on returned products or canceled services, and provide regular billing statements.

Fifty percent of shoppers 25 to 44 said they have used "Buy Now, Pay Later."

The rule goes into effect in 60 days. But unlike credit cards, many 'Buy Now, Pay Later Loans' do not affect credit scores.

More Like This

April 15th, 2025

December 16th, 2024

December 9th, 2024

Top Headlines

June 22nd, 2025

June 22nd, 2025