Elimination Of Historic Tax Credits Impacts Developers

<p>President Trump's tax reform plan is threatening the new life given to old buildings in Oklahoma.</p>Thursday, November 16th 2017, 6:50 pm

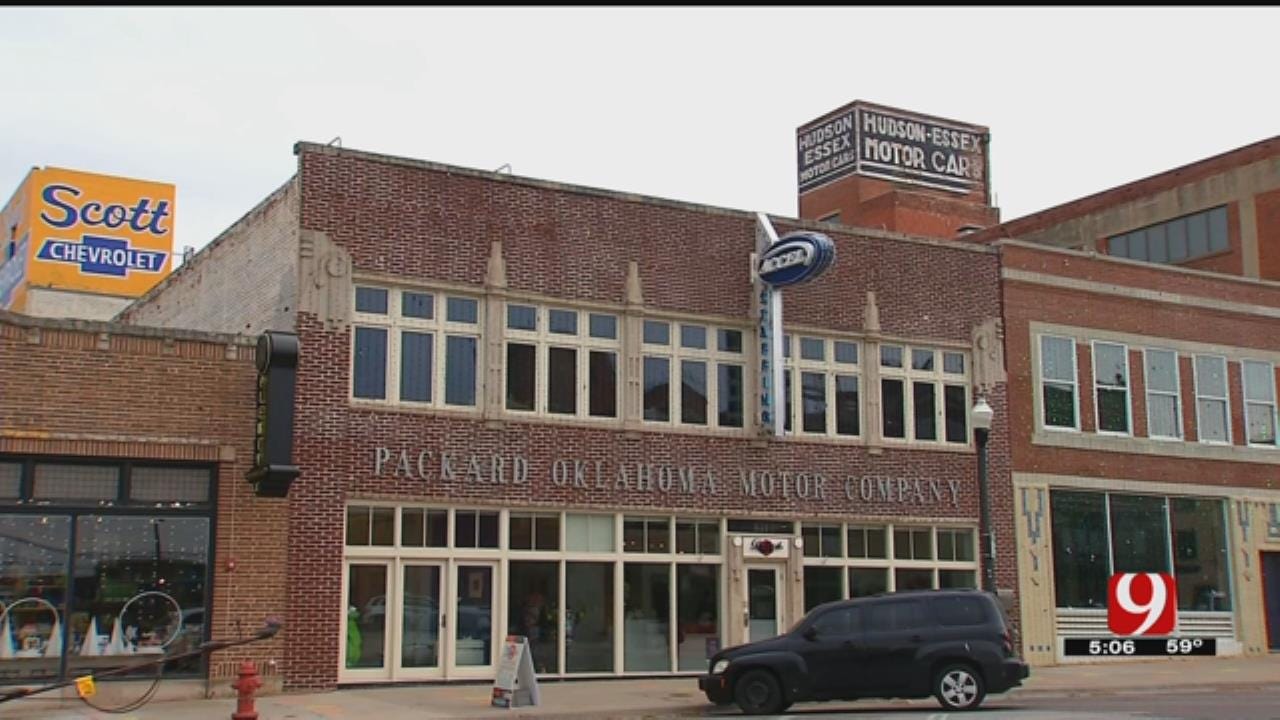

President Trump's tax reform plan is threatening the new life given to old buildings in Oklahoma.

He's calling for the elimination of historic tax credits. Other plans call for the credits to be scaled down.

Those credits are collected after a restoration is done so developers are dependent on the cash when they’re done with a restoration project.

Oklahoma City historic preservation Officer Katie Friddle says it's not just larger cities benefiting, but many small towns.

“It’s really small building on main street that bring jobs and business back to those centers,” says Friddle.

Since 2002, $450 million in historic tax credits has been spent on 77 buildings in 18 Oklahoma counties.

The president tax reform plan calls for the elimination of historic tax credits.

The current GOP House plan calls for a 20-percent reduction in the credits.

“If the credit goes away then projects that are in the process right now are kind of thrown into limbo,” adds Friddle.

The owners of the old Dunbar Elementary School building in NE OKC have just started of the process of qualifying for historic tax credits.

The developers of the Walcourt Apartments on NW 13th also plans to use the credits for their renovation.

The Developer of the First National Bank building in downtown OKC, Gary Brooks, says $40 of this $200 restoration is coming from historic tax credits.

More Like This

November 16th, 2017

January 2nd, 2025

September 29th, 2024

September 17th, 2024

Top Headlines

March 30th, 2025

March 30th, 2025

March 29th, 2025