Wagoner County Voters Reject Eight Different Tax Propositions

Voters in Wagoner County overwhelmingly rejected eight different ballot propositions in Tuesday's election. All would affect tax rates.Tuesday, March 5th 2024, 9:12 pm

WAGONER COUNTY -

Voters in Wagoner County overwhelmingly rejected eight different ballot propositions in Tuesday's election. All would affect tax rates.

One voter News On 6 spoke with says he's relieved with the results and had been standing outside holding signs against one of the propositions for more than 4 hours.

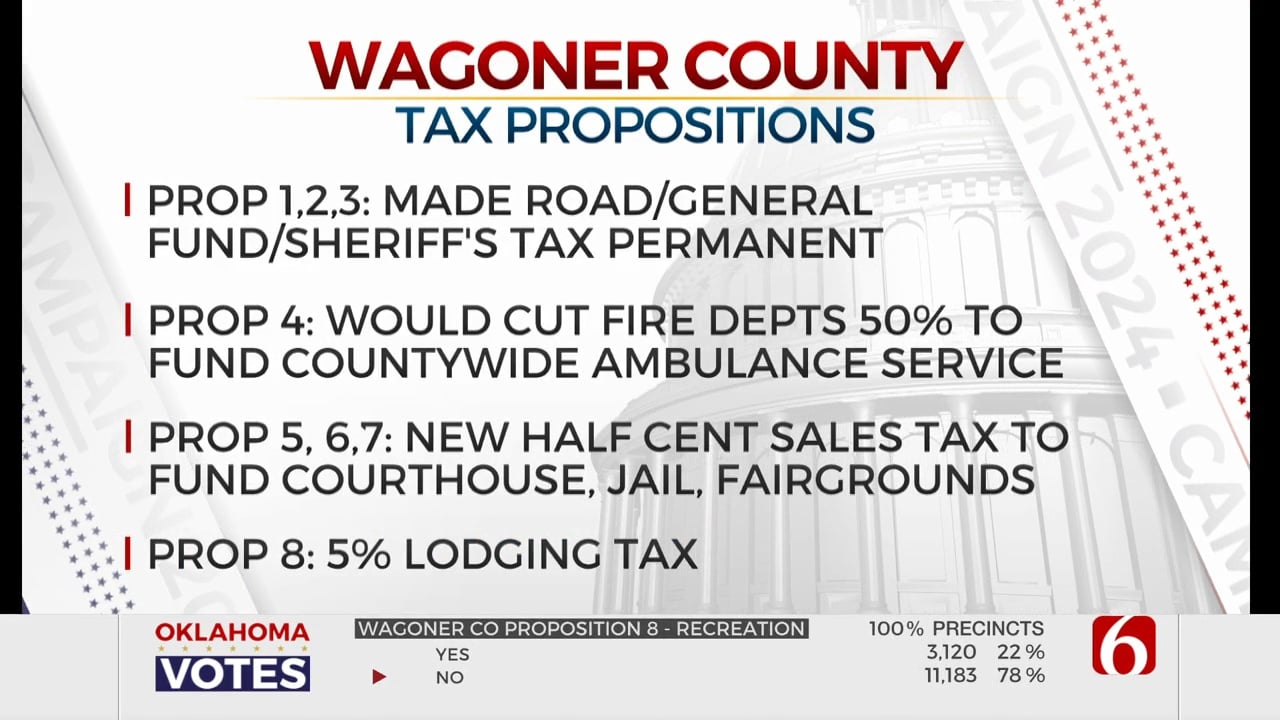

- Proposition 1: Make permanent the temporary 0.80% for operations and road and bridge improvements

- Proposition 2: Make permanent the temporary 0.10% for Sheriff Office capital outlay and operations

- Proposition 3: Make permanent the temporary 0.10% for General Fund purposes

- Proposition 4: Repurpose half of the permanent 0.30% fire tax approved in 2004 to establish and provide ambulance service

These next three would've created a new half-cent sales tax:

- Proposition 5: 0.125% for 30 years for courthouse facilities

- Proposition 6: 0.25% permanent for jail facilities and operations

- Proposition 7: 0.125% for 30 years for fairgrounds facilities

- Proposition 8: create 5% lodging tax in unincorporated areas with the money going to parks and recreational facilities

Voters rejected all eight propositions by a large margin.

Jeff Riddle is a member of the Oak Grove Volunteer Fire Department, and he says the results put 14 fire departments across Wagoner County at ease.

"I feel really good,” Riddle said. “We were not sure how this was going to go. Obviously, as a fire department, we need our funding; we're not just out here frivolously spending money."

The county says the decision to create a new ambulance service was because, in some cases, recent call times were more than an hour.

Chloe Abbott

Chloe Abbott joined News On 6 as a multimedia journalist in October 2023. She now serves as a reporter. Before joining the News On 6 team, she worked in Shreveport, Louisiana for two years as an anchor/MMJ for the ABC affiliate, KTBS. Chloe has covered severe weather, crime, sports, and Mardi Gras.

More Like This

March 5th, 2024

March 25th, 2025

Top Headlines

April 23rd, 2025

April 23rd, 2025

April 23rd, 2025