Your Money Matters: How Does The Stock Market Impact 401Ks, Retirement Plans

Triston Hasty-Grant from Waterstone Private Wealth Management discusses stock market volatility, portfolio management, and historical trends. He also highlights the significance of potential interest rate cuts by the Federal Reserve, which could positively impact the economy and large companies moving forward.Wednesday, August 28th 2024, 9:53 am

We've seen ups and downs in the stock market over the last few months and years, so it's hard to predict what will happen next.

Since that may be an important part of your retirement plan, we asked Triston Hasty-Grant with Waterstone Private Wealth Management to join News On 6 and put it into perspective.

Dave: So let's start with the basics. How does what we see on the stock market and the news relate to our investments? If we have 401(k) Roth IRAs, how does that relate to what we're seeing?

Triston: That's a great question. And the answer is, it relates kind to when people talk about the stock market, they're probably talking about the S&P 500 data or Dow Jones, And that's just a collection of stocks that gives you more or less an average of how all these different big companies are doing

Dave: So if you are at 401, K IRA, you have more sources. It's more of a portfolio.

Triston: That's right, It's like, that's your specific subscription or your specific prescription in the stock market as a whole. But you aren't the stock market as a whole. You've got a very narrow portfolio.

Dave: So let's talk about market volatility again. So what is market volatility? When we talk about that, what does that mean?

Triston: That's, that's another really good question. Market volatility is just talking about the ups and downs and those indexes as a whole. So the more volatility there is, the higher highs, the lower lows, and the faster we're swinging in between.

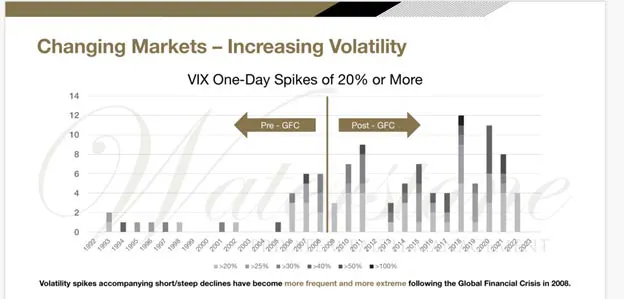

Dave: This graphic right here, the big black line, that is the Great Recession.

Triston: That's the great financial crisis of 2008.

Dave: So after that, we have seen a lot more volatile days. Tell me more black means more volatile days.

Triston: Dave, so as we look at this chart, the higher the bar, the more volatility we saw in that year. This is like a 20% swing.

Dave: This is like a 20% swing.

Triston: These are, these are 20% plus days. So this is the Volatility Index, the "VIX". So again, this is an average of the stock market and its volatility. But as you can simply see to the right of the line, the bars are higher, we're seeing historically more volatility and larger volatility today than we ever have. And there's a lot of contributing factors to that. You know, algorithmic trading, AI, all those kinds of things that are making stock trades even faster, move the markets even faster.

Dave: So, fewer human traders can contribute to...

Triston: There's more human participation, but those, those AIs and those algorithmic portfolios move quick.

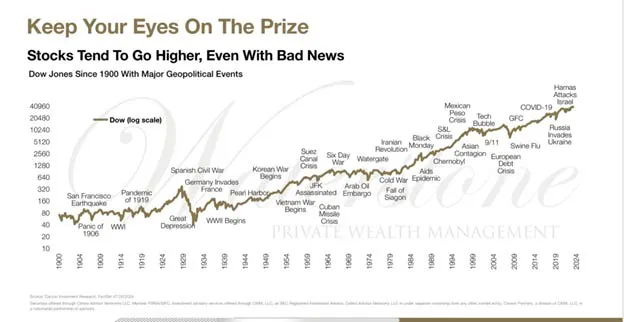

Dave: So you even put together a timeline. Another one. I love these charts. This is a historic timeline we're talking about. This goes back 120 years to show... what's the point of this graphic? Because we're seeing every single world crisis you can think of, Suez Canal to the 100-day war, to the Great Financial Crisis and beyond. What is the point of this here?

Triston: Dave, this, this here is, is the overall market, like we've talked about, and you're seeing some of the most awful headlines that we've ever experienced on this chart, specifically on the geopolitical front. So people remember the Cold War. People remember Black Monday, back in the 80s, the tech bubble, 9/11 all these really awful times were probably World Wars. Yeah, it probably felt like the end of the world. And you know, those things are scary and they're real to be taken seriously. But this chart just illustrates over time, the market always finds its way up, not that it doesn't have down days, not that it doesn't have down years, but we've got to invest for the long haul.

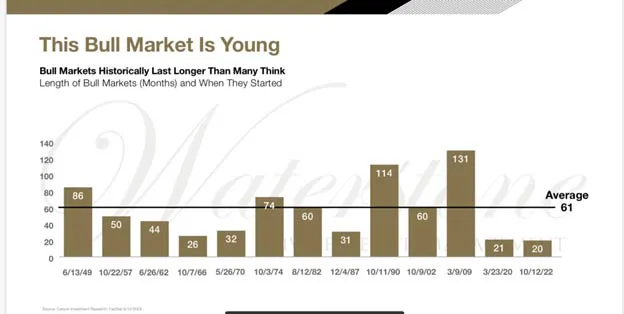

Dave: So you believe this current market that we're in, describe what you're seeing, and I mean, how long could this go?

Triston: Yeah, so you know, if everybody's crystal ball worked, you know, I would be out of a job. But I say that in jest, but we're still seeing a strong US consumer. We're still seeing a strong US economy. And all that being said is the average bull market, which I think you have a graph of here, where, you know, historically, we're in a short bull market, which only means this, this positive market is young. The average bull market lasts 61 months, and we're currently at about 20 to 22 months into this bull market. So, you know, history isn't a guarantee of returns, of course, but this is to say, from a historical perspective, there could be more legs under this thing.

Dave: The bull market that we're in is all the way to the right, right, yeah. And then we're talking about the 1990 bull market. That's 114 months. 2009 that's 131 months when that lasted. So one more question. I couldn't let you go without asking about interest rates. Jerome Powell, the Federal Reserve Chair, says the time has come to cut interest rates. What is your read on this?

Triston: I think that's huge news. You know, we talked about this bull market being young, something that could really give relief to the US economy, which is slowing, and that is important to point out is that lower interest rates will help these large companies that we're investing in continue to do business in an efficient way. So for Jerome Powell to come out and say so definitively, the time has come to have a change in policy. He hasn't done that in the better part of 24 months. So needless to say, the stock market is pricing in cuts, and so cuts in September will be important, but whether or not the Federal Reserve does 25 basis points or 50, who knows? But cuts will be important, we will know what happens in September.

More Like This

January 15th, 2025

January 14th, 2025

January 14th, 2025

Top Headlines

January 15th, 2025

January 14th, 2025

January 14th, 2025

January 14th, 2025